Introduction to Temporary Total Disability Benefits

Workers' compensation is a form of insurance that provides benefits in case of a workplace accident. One of these benefits is known as "temporary total disability" benefits, designed to compensate for lost wages. However, workers' compensation insurance doesn't fully replace lost wages; instead, it pays 2/3 of your lost wages up to a cap set by state law. As of July 1, 2022, the maximum weekly benefit is $725.

Starting the Checks

Temporary total disability benefits aim to provide lost wages quickly after a workplace accident. The workers' compensation insurance company or your employer should send a weekly check for as long as your disability prevents you from earning an income. State law mandates that the check be mailed to your residence.

Although these benefits are called "temporary," they could potentially last for the rest of your life if you have a catastrophic injury and can never return to work. You may receive these benefits as long as you can prove a "loss of wage-earning capacity" due to your workplace injury.

Typically, your treating doctor will provide work restrictions to determine if you're capable of working. If your employer cannot offer you work within the restrictions, they'll be responsible for paying you weekly workers' compensation benefits. The weekly checks will stop if your doctor issues a full-duty work release, or if your employer can accommodate you with suitable light-duty work.

This process may seem simple, but the system can be needlessly complicated and confusing for injured workers. You may encounter issues with urgent care or clinics not providing reasonable work restrictions. Workers' compensation insurance companies will usually refuse to pay for lost wages if you cannot show that a doctor has taken you out of work. Therefore, your initial choice of doctor is crucial. Issues may also arise when you return to work on light duty, as some employers may not honor the light-duty work restrictions. If you're facing any of these problems, seek the free advice of a workers' compensation attorney.

The Seven-Day Waiting Period

Before you can receive lost wage benefits, there's a waiting period. You're not entitled to lost income benefits unless you have missed at least seven days of work. If you miss 21 days, you become entitled to get paid for the first seven days as well.

How to Calculate Your Average Weekly Wage

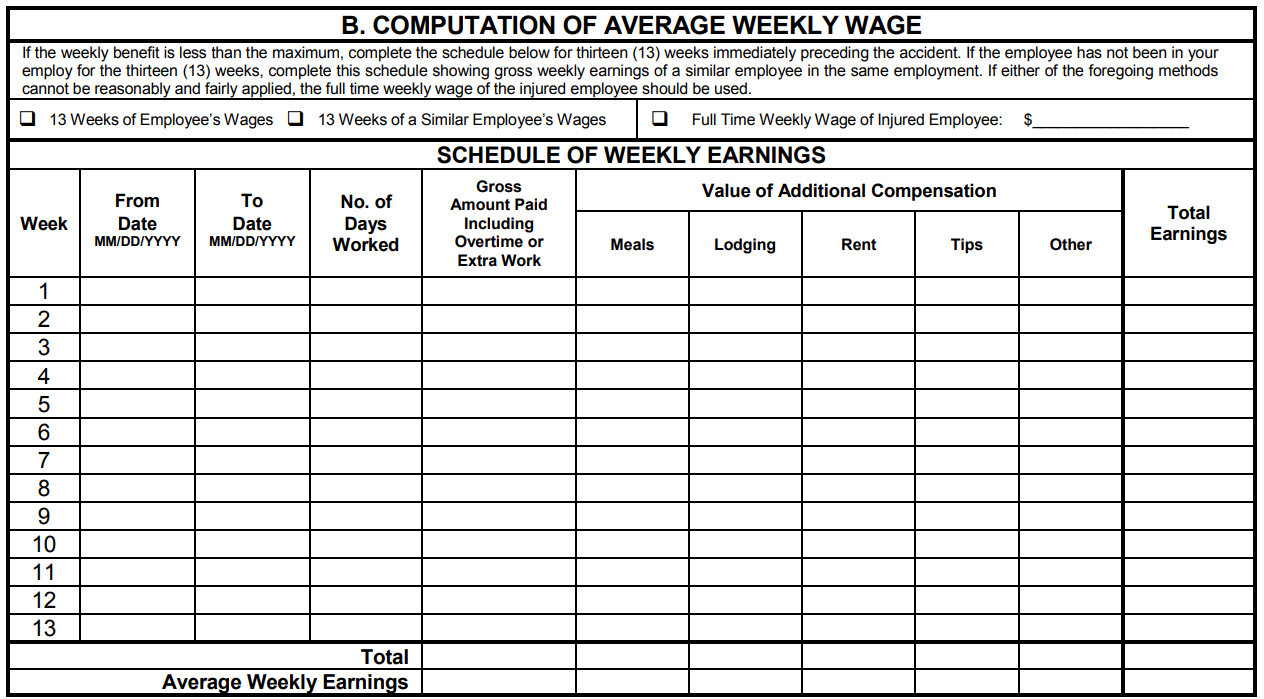

To calculate your average weekly wage, you should use your gross earnings (before taxes) from your job. Include your regular salary or hourly wage, as well as any overtime, bonuses, or commissions. The average weekly wage calculation should be based on the 13 weeks before your injury. If you haven't worked at your job for 13 weeks, your employer may use a similar employee's wage as a basis for calculating your average weekly wage.

Once you have determined your average weekly wage, multiply it by 2/3 to find out the amount of your weekly temporary total disability benefit. Remember, this amount is capped at $725 per week, as of July 1, 2022. Below is a form you can use to figure out how much you are owed in weekly benefits:

The Trial Return to Work Period

Often, after a workplace accident or surgery, you may be taken out of work. Eventually, your doctor might transition you to light-duty restrictions.

When you move from a "no work" status to "light-duty," your employer may offer you light-duty work. However, employers are not required to accommodate light-duty work if they choose not to. In many cases, employers would prefer not to have you back until you are ready for full-duty work, but insurance companies may pressure them. Insurance companies can threaten to raise employers' premiums if they do not accommodate light-duty work.

You have 15 days to attempt any light-duty work offered to you. If you unreasonably refuse to try a light-duty job, the insurance company may automatically terminate your benefits. You must attempt the job for eight hours or two scheduled shifts, whichever is greater. Unpaid lunch breaks do not count towards the eight hours.

If you attempt the required amount of time but cannot perform the light-duty work, the insurance company must automatically restart your benefits. However, they do not have to restart your benefits if you decide you cannot perform the job, but have already worked more than 15 days.

This is one of the many arbitrary deadlines common in workers' compensation. Be aware that your employer may terminate your employment if you work more than 15 days on light-duty restrictions. It is always a good idea to get a free consultation with an attorney before attempting a light-duty job offer.

My Doctor Released Me to Full Duty Even Though I Am Still Having Problems. Now What?

It can be concerning if your doctor releases you to full duty despite ongoing issues related to your workplace injury. If this happens, the insurance company is entitled to immediately suspend your workers' compensation weekly checks. In such situations, it is crucial to take the following steps:

- Communicate with your doctor: Make sure to discuss your concerns and symptoms with your doctor. They may not be aware of the extent of your problems or may need to reevaluate your condition based on your feedback.

- Seek a second opinion: If you believe your doctor is not addressing your concerns adequately, consider seeking a second opinion from another qualified medical professional. This can help ensure that your injury is accurately diagnosed and treated.

- Inform your employer: Keep your employer informed about your ongoing issues and any changes in your work restrictions. They should be aware of your situation and make reasonable accommodations accordingly.

- Consult with a workers' compensation attorney: If you face challenges with your workers' compensation claim or benefits, it is a good idea to consult with an experienced attorney. They can help you navigate the system and ensure you receive the appropriate support and compensation.

Remember, your well-being should be the top priority. Do not hesitate to advocate for yourself and seek the necessary help to ensure you recover fully and receive the benefits you deserve.

Frequently Asked Questions

1. How is my average weekly wage calculated if I didn't work the 13 weeks prior to the accident?

If you didn't work "substantially the whole" of the 13 weeks before the accident, the law provides two alternatives for calculating your average weekly wage. First, the wages of a similar employee can be used. If there are no similar employees, your average wage is based on the contract rate, i.e., your hourly wage multiplied by the expected number of hours you would work per week.

2. What are the different types of work restrictions my doctor can assign?

Your doctor can assign full duty, no-work, or light duty restrictions. If your doctor puts you on full duty, you will not be entitled to lost income benefits. If you're on a no-work status, you'll be entitled to lost income benefits. If your doctor assigns light duty restrictions and your employer doesn't offer you work within those restrictions, you'll receive weekly workers' compensation benefits.

3. What if my employer assigns work that violates my work restrictions?

If your employer assigns work that violates your restrictions, you should consult with a workers' compensation attorney, as these situations depend on the specific facts of your case.

4. Can I receive benefits if I'm making less money due to the accident?

If you return to light duty work but earn less than before the accident, workers' compensation insurance owes you 2/3 of the difference. This is called "temporary partial disability" benefits.

5. What happens to my lost income benefits if I quit or get fired while on light duty work restrictions?

If you quit while on light-duty restrictions, the insurance company may deny your weekly benefits. If you're fired, you may be entitled to lost income benefits, depending on the reason for the termination. In either case, consulting with a workers' compensation lawyer is recommended.

6. How long can I receive weekly lost income checks?

You could potentially receive a lost income check for up to 400 weeks. If your case is catastrophic, meaning you're incapable of performing any work in the national economy, there is no time limit for receiving benefits. However, if you have been on light-duty restrictions for 52 consecutive weeks or 78 aggregate weeks, the insurance company could limit your benefits to 350 weeks.