Insurance Coverage Limits in Georgia Car Accidents: What Accident Victims Should Know

Published: 4/3/2025

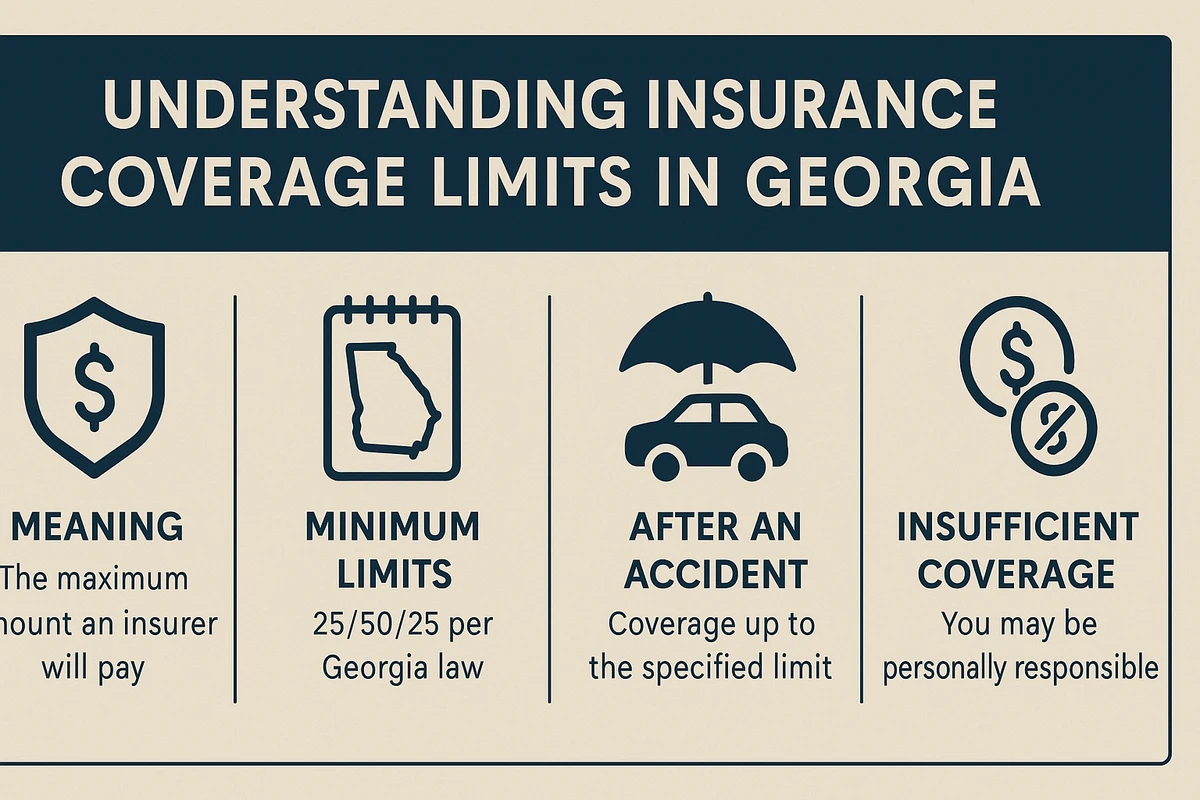

Understanding insurance coverage limits is crucial for anyone involved in an accident. In Georgia, as in other states, coverage limits refer to the maximum amount an insurance company will pay for a covered claim under a policy. Each type of liability coverage (auto, homeowners, business, etc.) has its own limits. This article explains what coverage limits mean under Georgia law, how they work for different types of liability insurance, and why they matter to accident victims and policyholders.

What Are Insurance Coverage Limits?

Insurance coverage limits are essentially the financial cap of an insurance policy’s protection. They dictate the highest payout the insurer will make for a claim. If an accident causes damages beyond these limits, the insurer will only pay up to the limit – any excess damages may become the responsibility of the policyholder or remain uncompensated to the victim. For example, if you have a liability limit of $50,000 for bodily injury and you cause $75,000 in injuries, the insurer pays $50,000 and the remaining $25,000 would not be covered by your policy. This is why it’s important for individuals to know their limits and carry sufficient coverage to avoid large out-of-pocket costs.

Georgia law influences coverage limits by setting minimum required amounts for certain policies (like auto insurance) and by outlining how liability works in accidents. It’s a fault-based state, meaning the at-fault party’s insurance is expected to pay for the damages they cause. If those damages exceed the coverage limit, the victim could be left with unpaid losses, and the at-fault person could be personally liable for the rest. In the sections below, we break down coverage limits for various common liability policies in Georgia and what they mean in real-life accident scenarios.

Per Person vs. Per Accident vs. Aggregate Limits Explained

When looking at liability insurance, you’ll encounter terms like “per person,” “per accident” (or per occurrence), and “aggregate” limits. These define how the coverage limit is applied:

Per Person Limit: This is the maximum amount the policy will pay for one individual’s injuries in a single incident. For example, an auto policy with a $25,000 per person limit will pay up to $25,000 for each person injured in an accident. No single victim can receive more than this cap from that policy, even if their damages are higher.

Per Accident (Per Occurrence) Limit: This is the maximum total the insurer will pay for all injuries or claims from one accident. For instance, Georgia’s minimum auto policy has a $50,000 per accident limit for bodily injury. That means if multiple people are hurt in one crash, the insurance will pay no more than $50,000 in total for everyone’s injuries combined. If two or three people are injured, their individual payouts must fit within that $50,000 combined cap. Once the per-accident limit is reached, the insurer stops paying, even if some victims haven’t been fully compensated.

Aggregate Limit: This applies to some policies (commonly business liability or umbrella policies) and is the maximum amount the insurer will pay for all claims during the policy period (usually a year). In other words, it’s a cap on the total payout for multiple incidents. For example, a business general liability policy might have a $2 million aggregate limit for the year. If the policy has a $1 million per-occurrence limit and $2 million aggregate, it could pay up to $1 million for one incident, but if several incidents occur, payments are capped at $2 million for the year. As one Georgia resource explains, the per-occurrence limit is the amount available for each incident, while the aggregate is the total available for multiple incidents combined.

Example: Imagine a driver has an auto policy with $25,000 per person and $50,000 per accident limits for bodily injury (often written as 25/50). If that driver causes a crash injuring three people, each victim can receive up to $25,000, but the insurer will not pay more than $50,000 total for the accident. So if all three have serious injuries of $30,000 each (total $90,000), the policy might pay $25,000 to two of them ($50,000 total) and nothing for the third, because the $50,000 per-accident cap has been reached. Any remaining damages would be unpaid by insurance. On the other hand, a business with a $1M per occurrence/$2M aggregate liability policy could cover an incident up to $1 million, and if multiple smaller incidents happen in the same year, it will pay out claims until the $2 million aggregate cap is met.

Understanding these terms is important so you know how much coverage is actually available in a given situation. Per person and per accident limits mainly come into play with auto insurance and certain liability policies, whereas an aggregate limit typically matters in commercial and umbrella policies that cover multiple events over time.

Auto Liability Insurance Limits in Georgia

Auto liability insurance covers injuries or property damage you cause to others in a car accident. Georgia law requires all drivers to carry a minimum amount of auto liability insurance to operate a vehicle legally. These state minimum liability limits are often written as 25/50/25. In plain terms, that means:

-

$25,000 bodily injury liability per person – the most the insurer will pay to one person injured in a crash you cause.

-

$50,000 bodily injury liability per accident – the most the insurer will pay in total for all injuries in one accident (no matter how many people are hurt).

-

$25,000 property damage liability per accident – the most the insurer will pay for damage to other people’s property in one accident (such as repair or replacement of vehicles, fences, etc.).

These limits are minimum requirements set by Georgia law. They provide a basic level of financial protection. In practice, however, serious accidents often cost more than these amounts. Medical bills and vehicle replacements can quickly exceed the minimum limits. For example, $25,000 per person might not fully cover even a moderate car accident injury when you consider hospital bills, lost income, and pain and suffering. Georgia drivers frequently choose higher liability limits than the minimum to better protect themselves financially. Common auto liability choices are 50/100/50 or 100/300/100 (meaning $100,000 per person, $300,000 per accident for injuries, and $100,000 for property damage), among other options.

How Georgia’s auto coverage limits work

If you are at fault in an accident, your liability insurance will pay the other party’s medical bills, lost wages, and damage up to your policy’s limits. For instance, with the minimum 25/50/25 policy, if you injure one person, your insurer can pay up to $25,000 for their injuries. If you injure two or more people, it will pay no more than $50,000 total for everyone. Likewise, property damage you cause (to someone’s car or other property) is covered up to $25,000. After these limits, the insurance is exhausted. At that point, victims may not get fully reimbursed for their costs, and you as the at-fault driver could be held personally responsible for the remaining damages.

Georgia is an at-fault (tort) state for auto accidents, which means injured parties typically file claims against the at-fault driver’s liability insurance. Most of the time, claims are resolved within the available policy limits. However, if a catastrophic crash causes very high losses, the minimum limits might not be sufficient. Imagine causing a multi-car pileup or hitting a pedestrian – the costs could far exceed a 25/50/25 policy. In such cases, accident victims might only recover up to the policy limits and then be left to cover the rest of their expenses on their own. This is why carrying higher limits (or having an umbrella policy, discussed below) can be crucial. Higher limits mean more protection for both the victim and the at-fault driver’s personal assets in a worst-case scenario.

Key Georgia Auto Insurance Facts:

You can buy higher limits for more protection. Insurers offer higher split limits (like 50/100/50, 100/300/100) or even a combined single limit policy that provides one lump-sum limit for all damages in an accident (e.g. $300,000 single limit).

Uninsured/Underinsured Motorist (UM) coverage is optional in Georgia but often recommended. UM coverage can pay for your injuries if an at-fault driver has no insurance or not enough insurance to cover your losses. (While UM is not liability insurance, it’s worth noting as it helps accident victims in cases where the at-fault driver’s liability coverage is insufficient.)

What Happens When Damages Exceed Policy Limits?

When damages from an accident exceed the policy’s liability limits, a few important things occur:

The insurer pays out the maximum, and no more. Insurance companies are contractually bound to pay only up to the limit you purchased. Once they have paid that amount, their obligation is fulfilled. For example, they might issue a check for the full $50,000 per-accident limit (in a case of multiple injuries) or the full $25,000 property damage limit for a totaled car, and then they’re done. Any claims above that are not covered by the policy.

The at-fault party is on the hook for the rest. Legally, the person who caused the accident is responsible for all damages they caused – their insurance just helps cover that responsibility up to the policy amount. So if the damages are greater, the liability shifts back to the individual (or business) who is at fault. In Georgia, an at-fault individual can be held liable for the amount of a judgment that exceeds insurance coverage. The injured party can attempt to recover the remainder by pursuing the at-fault party’s personal assets. This often means a lawsuit, if one hasn’t been filed already. Simply put, if a claim exceeds your insurance limits, you are typically responsible for paying the difference out of pocket, and the other party may file a lawsuit to obtain that remaining amount from you. This can result in wage garnishment, property liens, or other collection methods if the court awards the excess damages to the victim.

Settlement dynamics

In practice, when policy limits are clearly below the value of a claim, there is a strong incentive for all parties to settle the claim for the insurance limits. From the injured victim’s side, there’s not much point in protracted litigation if the best they’ll ever actually collect is the insurance money (especially if the at-fault person has limited resources). From the insurer’s side, they often will agree to pay the full limit to resolve the claim and protect their policyholder from further exposure. However, this isn’t always automatic; negotiations still happen. In some cases, a victim might refuse a policy-limits settlement and pursue a trial hoping to identify other defendants or insurance policies. But generally, if damages clearly exceed the available insurance, the case will settle for the policy limits relatively quickly because that’s the practical ceiling of recovery.

Umbrella policy comes into play (if available): If the at-fault party has an umbrella or excess liability policy, this is exactly when it would activate. The umbrella insurer would then continue paying up to its limit after the primary policy is exhausted. So, exceeding the auto or homeowners limit isn’t as catastrophic if an umbrella policy adds, say, another $1 million in coverage. The claim would then effectively be covered up to that higher amount. If damages exceed even the umbrella, then anything above all insurance still falls to the at-fault party personally.

Bankruptcy or other outcomes: If a person is found liable for a huge amount beyond their insurance and cannot pay, they might end up declaring bankruptcy to discharge the legal judgment (although not all injury judgments can be discharged easily, and this is complex legal territory beyond this discussion). For victims, this means that sometimes there is simply no viable source from which to collect the full damages – illustrating again the importance of adequate insurance and also why victims are wise to carry underinsured motorist coverage for auto accidents as a safety net.

In summary, when an accident’s costs exceed the insurance coverage limits, it creates a difficult situation: the insurance policy has done all it can (paid its max), leaving a gap. Accident victims then face either absorbing that gap themselves or chasing the at-fault party’s assets, and at-fault individuals face potential lawsuits and personal financial exposure. It’s a scenario to be avoided if possible, which is why both victims and responsible parties prefer that sufficient insurance is in place beforehand.

Conclusion

Insurance coverage limits might seem like just numbers on a policy, but in an accident they become incredibly important. They determine how much money is available to cover injuries and damages under the policy. In Georgia, knowing the specifics – like the 25/50/25 minimum for auto insurance – and recognizing when those amounts might fall short is key to protecting yourself. Auto, homeowners, business, and umbrella liability policies each play a role in covering different accident scenarios:

-

Auto liability insurance follows Georgia’s legal requirements and protects you on the road up to the per-person and per-accident limits you choose.

-

Homeowners liability coverage safeguards you if someone is hurt on your property or by your actions as a homeowner, with common limits ranging from $100k into the hundreds of thousands.

-

Business liability policies defend your livelihood by covering accidents at your business or caused by your operations, often with a per-occurrence/aggregate structure (like $1M/$2M).

-

Umbrella policies sit on top of those, providing extra coverage so that a major incident doesn’t exceed your total insurance protection.

For Georgia accident victims, this all means that the amount of insurance the at-fault party carries can directly impact how much compensation you can recover. For policyholders, it means that skimping on liability coverage could put your personal finances at risk if you ever cause a serious accident. It’s wise to evaluate your own situation and consider higher limits or an umbrella policy if you have assets to protect or simply want peace of mind. Liability insurance is relatively affordable compared to the protection it provides, and Georgia law encourages responsible coverage to ensure that when accidents happen, there’s enough money available to compensate those who are harmed.

In the end, understanding your coverage limits – and the difference between per person, per accident, and aggregate caps – will help you make informed decisions and avoid unpleasant surprises. Stay informed, carry adequate coverage, and if you’re ever unsure about your insurance needs, consult with a licensed insurance professional to review your policy limits. Being prepared is the best way to navigate the aftermath of an accident safely and securely.

Related Articles