Lost Income Benefits Guide for Injured Workers

If you are injured at work, you may be entitled to a weekly wage replacement check if you are unable to work because of your injury. Workers’ compensation insurance doesn’t fully replace lost wages; instead, it pays 2/3 of your lost wages up to a cap set by state law. As of July 1, 2022, the maximum weekly benefit is $725.

The Seven-Day Waiting Period

Before you can receive lost wage benefits, there’s a waiting period. You’re not entitled to lost income benefits unless you have missed at least seven days of work. If you miss 21 days, you become entitled to get paid for the first seven days as well.

Examples

Imagine an injured worker named Sarah who works at a warehouse in Georgia.

Misses 6 Days: Sarah injures her back and misses the first six days of work. Since she hasn’t reached the seven-day threshold, she isn’t eligible for lost wage benefits yet.

Misses 7 Days: If Sarah ends up missing a seventh day due to her injury, she finally meets the waiting period requirement. However, she wouldn’t receive benefits for those first seven days; instead, her lost wage benefits would start accruing from the eighth day onward.

Misses 21 Days: If Sarah’s injury forces her to be off work for a total of 21 days, the rules change. In this case, she becomes entitled to retroactive lost wage benefits for the initial seven-day waiting period as well. That means she would be compensated for all 21 days of her missed work.

Starting the Income Replacement Checks

In worker’s compensation, you may recieve a form of income replacement called Temporary Total Disability or “TTD”. TTD benefits aim to provide lost wages quickly after a workplace accident. The workers’ compensation insurance company or your employer should send a weekly check for as long as your disability prevents you from earning an income. State law mandates that the check be mailed to your residence.

Typically, your treating doctor will provide work restrictions to determine if you’re capable of working. If your employer cannot offer you work within the restrictions, they’ll be responsible for paying you weekly workers’ compensation benefits. The weekly checks will stop if your doctor issues a full-duty work release, or if your employer can accommodate you with suitable light-duty work.

This process may seem simple, but the system can be needlessly complicated and confusing for injured workers. You may encounter issues with urgent care or clinics not providing reasonable work restrictions. Workers’ compensation insurance companies will usually refuse to pay for lost wages if you cannot show that a doctor has taken you out of work. Therefore, your initial choice of doctor is crucial. Issues may also arise when you return to work on light duty, as some employers may not honor the light-duty work restrictions. If you’re facing any of these problems, seek the free advice of a workers’ compensation attorney.

Example

After a workplace accident, Mike injures his back and sees a doctor who clearly states he can’t perform heavy lifting. Since his employer doesn’t have any light-duty work available that fits his restrictions, Mike starts receiving weekly Temporary Total Disability (TTD) checks mailed to his home. These payments continue until his doctor either clears him for full-duty work or his employer finds a suitable light-duty role. If his initial doctor had failed to document his work restrictions properly, Mike might have faced delays or denials of his benefits, making it crucial to choose the right doctor from the start.

Still Working but Making Less Money Due to Injury

If you are still working but earning less money due to your injury, you may be entitled to a different type of benefit called Temporary Partial Disability or “TPD.” TPD benefits are calculated based on the difference between your pre-injury average weekly wage and your post-injury earnings. The insurance company will pay you 2/3 of the difference, up to a maximum of $483 per week as of July 1, 2022.

If eligible, the TPD benefits are calculated as two-thirds of the difference between the pre-injury average weekly wage and the post-injury weekly wage, subject to a statutory maximum and a duration limit of 350 weeks from the date of injury.

However, if the employee’s reduced earnings are due to factors unrelated to the injury, such as economic downturns, voluntary job changes, or personal reasons, they may not qualify for TPD benefits.

Example

After his injury, Alex returns to work but can only perform limited duties. Before the injury, he earned $750 per week; now he earns $600. The difference is $150. Under TPD, he’d receive 2/3 of this difference—about $100 per week—provided the wage reduction is due solely to his injury.

How Long You Can Receive Weekly Checks

Although these benefits are called “temporary,” they could potentially last for the rest of your life if you have a catastrophic injury and can never return to work. You may receive these benefits as long as you can prove a “loss of wage-earning capacity” due to your workplace injury.

If your claim is not catastrophic, you may receive these benefits for up to 400 weeks from the date of your injury. However, if you are still unable to work after 400 weeks, you may be eligible for a different type of benefit called Permanent Partial Disability or “PPD.” PPD benefits are based on the severity of your injury and the extent of your permanent disability.

How to Calculate Your Average Weekly Wage

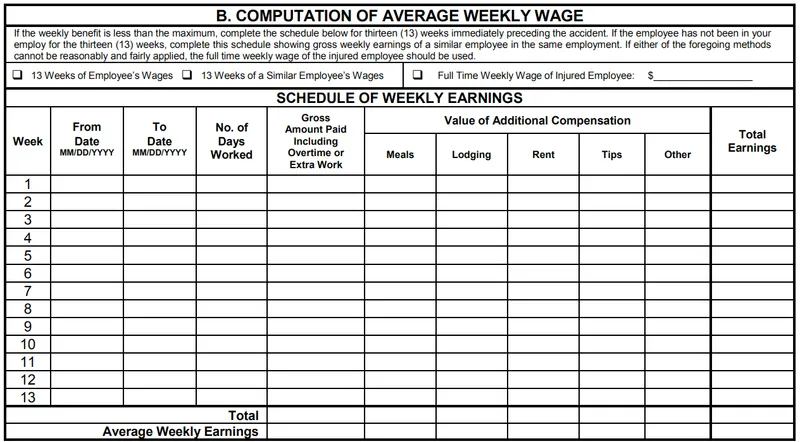

To calculate your average weekly wage, you should use your gross earnings (before taxes) from your job. Include your regular salary or hourly wage, as well as any overtime, bonuses, or commissions. The average weekly wage calculation should be based on the 13 weeks before your injury. If you haven’t worked at your job for 13 weeks, your employer may use a similar employee’s wage as a basis for calculating your average weekly wage.

Once you have determined your average weekly wage, multiply it by 2/3 to find out the amount of your weekly temporary total disability benefit. Remember, this amount is capped at $725 per week, as of July 1, 2022. Below is a form you can use to figure out how much you are owed in weekly benefits:

Suspension of income benefits

The insurance company can stop payment of weekly checks for the following reasons:

- Your doctor releases you to full duty work.

- You refuse to attend an Independent Medical Examination (IME) requested by the insurance company.

- Your emploter has suitable light-duty work available for you, but you refuse to accept it.

- You have recieved the maximum number of weeks of benefits allowed by law.

It can be concerning if your doctor releases you to full duty despite ongoing issues related to your workplace injury. If this happens, the insurance company is entitled to immediately suspend your workers’ compensation weekly checks. In such situations, it is crucial to take the following steps:

- Communicate with your doctor: Make sure to discuss your concerns and symptoms with your doctor. They may not be aware of the extent of your problems or may need to reevaluate your condition based on your feedback.

- Seek a second opinion: If you believe your doctor is not addressing your concerns adequately, consider seeking a second opinion from another qualified medical professional. This can help ensure that your injury is accurately diagnosed and treated.

- Inform your employer: Keep your employer informed about your ongoing issues and any changes in your work restrictions. They should be aware of your situation and make reasonable accommodations accordingly.

- Consult with a workers’ compensation attorney: If you face challenges with your workers’ compensation claim or benefits, it is a good idea to consult with an experienced attorney. They can help you navigate the system and ensure you receive the appropriate support and compensation.

Remember, your well-being should be the top priority. Do not hesitate to advocate for yourself and seek the necessary help to ensure you recover fully and receive the benefits you deserve.

Example

Jane, an injured worker, initially receives weekly compensation checks after her workplace accident. Later, her doctor unexpectedly clears her for full-duty work, even though she continues to experience significant pain and mobility issues. As a result, the insurance company immediately suspends her workers’ compensation checks. Concerned about her ongoing symptoms, Jane discusses her condition with her doctor to express her unresolved issues and requests a re-evaluation. Jane also informs her employer about her persistent work restrictions and consults with a workers’ compensation attorney to navigate the situation and ensure she receives the benefits she is entitled to. Her attorney helps her get a second opinion.

Restarting income benefits after they stopped

Sometimes an employee will return to work after being out of work for a while, but then their condition worsens and they can no longer work. In such cases, the employee may be entitled to restart their income benefits.

The employee must demonstrate that their physical condition has worsened to the point that they can no longer work at all. This worsening must be directly related to the compensable injury. For example, if the employee’s condition deteriorates after returning to work, they may qualify for a resumption of benefits.

If there is no physical worsening, the employee can still prove an economic change in condition. This requires showing that they have been denied suitable employment elsewhere due to the compensable injury. The employee must also demonstrate that they made a diligent but unsuccessful effort to secure suitable employment.

The employee must comply with statutory deadlines and procedural requirements. For example, under O.C.G.A. § 34-9-104(b), a request for a change in condition must be filed within two years of the last payment of income benefits.

In summary, the employee must provide evidence of a change in condition for the worse, whether physical or economic, and establish a causal link to the compensable injury. Procedural compliance and adherence to statutory deadlines are also critical.

Example

David missed six months of work due to a back injury and was paid a weekly check while he was out of work. Afterwards, he returned to work but his condition steadily worsened until he could no longer perform his job. Although his deteriorating condition was clearly linked to his compensable injury, David delayed hiring an attorney, assuming he could manage the process on his own. By the time he finally sought legal help, he had missed the statutory deadline for filing a change in condition under O.C.G.A. § 34-9-104(b). Consequently, his request to restart income benefits was denied, highlighting the importance of prompt legal action when conditions worsen.

The Trial Light-Duty Return to Work

When you were previously unable to work, but your doctor places you on “light-duty” work restrictions, your employer may offer you a light duty position. However, employers are not required to accommodate light-duty work if they choose not to.

The trial return-to-work process is intended to test the injured worker’s ability to perform the light-duty job within their restrictions. This process ensures that the employee is not prematurely removed from benefits if they are unable to sustain the work due to their injury

You have 15 days to attempt any light-duty work offered to you. If you unreasonably refuse to try a light-duty job, the insurance company may automatically terminate your benefits. You must attempt the job for eight hours or two scheduled shifts, whichever is greater. Unpaid lunch breaks do not count towards the eight hours.

If you attempt the required amount of time but cannot perform the light-duty work, the insurance company must automatically restart your benefits. However, they do not have to restart your benefits if you decide you cannot perform the job, but have already worked more than 15 days.

This is one of the many arbitrary deadlines common in workers’ compensation. Be aware that your employer may terminate your employment if you work more than 15 days on light-duty restrictions. It is always a good idea to get a free consultation with an attorney before attempting a light-duty job offer.

Example

Mark, who had an attorney from the outset of his claim, was transitioned to light-duty work following his injury. His employer offered him a light-duty position under pressure from the insurance company, and Mark’s attorney advised him to carefully adhere to the 15-day trial period. Mark worked the required shifts and meticulously documented his difficulties in performing the tasks. Despite his efforts, the physical demands proved too much, and his benefits were automatically restarted, ensuring his income replacement continued without interruption.

Penalties for Late or Missed Payments

If an employer fails to pay lost income benefits when due, the penalties are governed by O.C.G.A. § 34-9-221(e). Under this provision, if income benefits payable without an award are not paid when due, the employer is liable for a penalty of 15% of the accrued income benefits. This penalty is mandatory unless the employer has filed a timely notice of controvert or the nonpayment is excused by the Board after a showing that the failure to pay was due to conditions beyond the employer’s control.